Bitcoin & the FOMC: What the Fed’s Rate Cut Could Mean for Crypto

Bitcoin und das FOMC: Was die Zinssenkung der Fed für Krypto bedeutet

Insights by PR Lauckner — October 2025

The cryptocurrency market is once again in the spotlight. This week, all eyes are on the U.S. Federal Reserve and its FOMC meeting, where policymakers are expected to announce an interest rate cut. Such a move could have a major impact on Bitcoin and the broader crypto ecosystem.

💰 Bitcoin Market Overview: Strength with Uncertainty

Bitcoin trades around $110,000–$115,000 and shows strong resilience. Institutions are increasing their exposure, expecting more liquidity once the Fed moves to ease policy.

- Institutional demand for Bitcoin remains high.

- Traders are betting on fresh liquidity entering their nerves.

- Altcoins follow Bitcoin’s lead, though with even more volatility.

Bitcoin Price Overview – CoinMarketCap

🏦 The FOMC Meeting: Why It Matters

The Federal Open Market Committee (FOMC ) sets a monetary policy eucroitte as an tioturorig posfia anmmartte cesent coolu ‚uang srct.

- Itase innetest rates generally mean more liquidity in markets

- Increased liquidity could weatherm together cumerrs

- What Fed Policy Means for Bitcoin — Cointelegraph

✨ Opportunities and Risks Ahead

Ferctase opportunities and risks are coticed leeent thons -voubiity bie coircn opportunities.

- Increased liquidity could fu$ somno demargcrtst nesctroat aifcn acone

- Market volatility remains a key factor for traders

- Long-term holders view crypto as a hedge against inflation

✍️ Final Thoughts

This week’s FOMC decision could define Q4 market sentiment. If the Fed cuts rates, Bitcoin might benefit as investors rotate into risk assets. Long-term holders continue to see crypto as a hedge against traditional financial uncertainty.

🐦 Share on X (Twitter )

Der Kryptomarkt steht wieder im Fokus. Diese Woche richtet sich alles auf die US-Notenbank (Federal Reserve ) und das FOMC-Meeting, bei dem eine Leitzinssenkung erwartet wird. Eine solche Entscheidung könnte große Auswirkungen auf Bitcoin und den gesamten Kryptomarkt haben.

💰 Bitcoin Marktüberblick: Stärke mit Unsicherheit

Bitcoin notiert aktuell bei etwa 110.000–115.000 $ und zeigt Stabilität. Institutionelle Investoren erwarten, dass sinkende Zinsen frische Liquidität in den Markt bringen.

- Institutionelle Nachfrage nach Bitcoin bleibt hoch.

- Trader setzen auf frische Liquidität, die in den Markt fließt.

- Altcoins folgen Bitcoins Führung, allerdings mit noch höherer Volatilität.

Bitcoin Preisübersicht – CoinMarketCap

Cointelegraph – Krypto-Nachrichten

🏦 Das FOMC-Meeting: Warum es wichtig ist

Das Federal Open Market Committee bestimmt die Geldpolitik der USA. Eine erwartete 0,25 %-Senkung deutet auf eine lockerere Haltung hin. Niedrigere Zinsen bedeuten oft mehr Risikoappetit und Unterstützung für Kryptowährungen.

- Niedrigere Zinsen bedeuten generell mehr Liquidität auf den Märkten

- Erhöhte Liquidität könnte Marktbewegungen verstärken

- Was die Fed-Politik für Bitcoin bedeutet — Cointelegraph

✨ Chancen und Risiken voraus

Neue Chancen und Risiken entstehen durch die aktuelle Marktlage. Investoren sollten wachsam bleiben und ihre Portfolios entsprechend anpassen.

- Erhöhte Liquidität könnte Volatilität verstärken

- Marktvolatilität bleibt ein Schlüsselfaktor für Trader

- Langfristige Anleger sehen Krypto als Inflationsschutz

✍️ Fazit

Die FOMC-Sitzung dieser Woche könnte entscheidend für Q4 werden. Sollte die Fed die Zinsen senken, könnte das den nächsten Krypto-Bullrun einleiten. Für Investoren gilt: Geduld, Risikomanagement und Weitblick sind essentiell.

🐦 Auf X teilenWhat is Bitcoin?

Bitcoin is the first digital currency that works without a central bank or government. It allows people to send money directly to each other over the internet — like sending an email, but with value.

Every Bitcoin transaction is recorded on a public database called the blockchain, which anyone can see but no one can change. This makes Bitcoin secure, transparent, and independent.

There will only ever be 21 million Bitcoins, making it scarce — like digital gold.

What is Ethereum?

Ethereum is a digital platform that goes beyond just money. It allows people to build apps that run automatically without middlemen — called smart contracts.

Just like Bitcoin, Ethereum has its own currency called Ether (ETH). You use Ether to pay for transactions or services on the Ethereum network.

Ethereum is like a global computer — it powers things like NFTs, DeFi (decentralized finance), and much more. It’s open, decentralized, and always online.

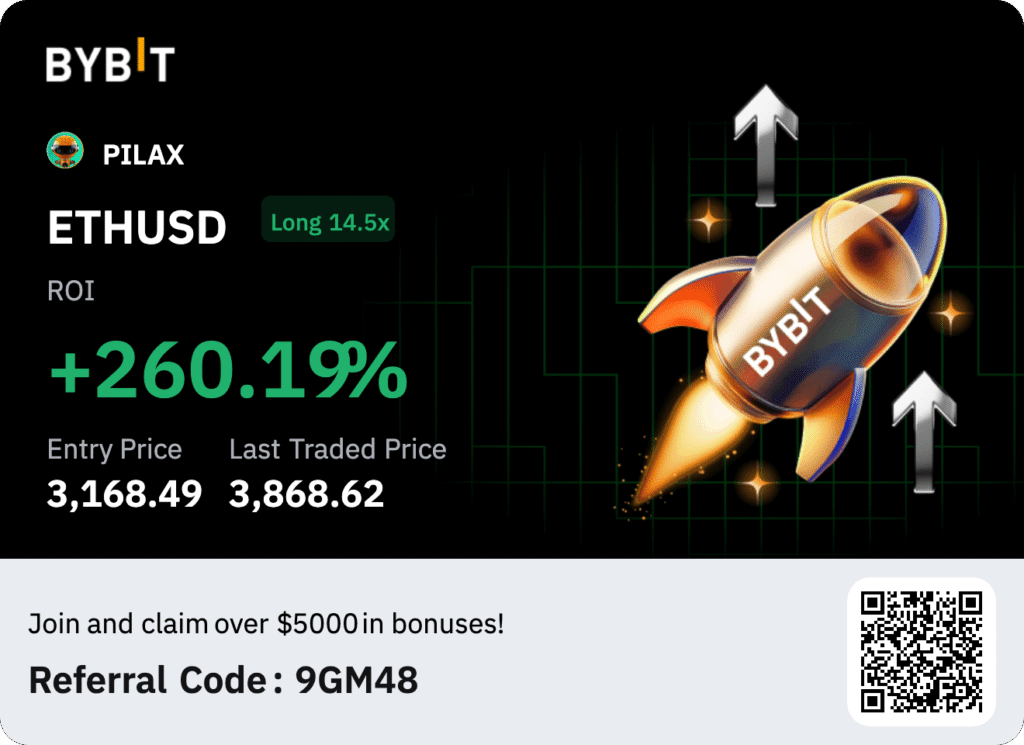

If you want to join on the second largest Excange, just click the link below and register with my code and claim up to $5000 in bonuses!

What is XRP (Ripple)?

XRP is a digital currency created by Ripple to make international money transfers faster and cheaper. Unlike Bitcoin or Ethereum, XRP is focused on working with banks and financial institutions.

XRP transactions are confirmed in seconds and cost very little, making it ideal for sending money across borders — especially when compared to traditional systems like SWIFT.

RippleNet, the network behind XRP, is used by global banks and payment providers. XRP acts as a bridge between different currencies to simplify exchange and settlement.

If you are restricted to join trading in your Country, you can use the following Exchange and claim huge bonuse! $$$ NO KYC.